Introduction: In recent years, sustainable investing, also known as Environmental, Social, and Governance (ESG) investing, has witnessed a remarkable surge in popularity. Investors and businesses alike are increasingly recognizing the importance of aligning financial goals with environmental and social objectives. As sustainability becomes a focal point for global economic development, ESG funds have consistently outperformed traditional investment vehicles, indicating a paradigm shift towards more conscientious financial practices.

- The Rise of Sustainable Investing: The concept of sustainable investing has its roots in the early 1970s, but it wasn’t until the last decade that it gained significant traction. Investors began to appreciate the importance of incorporating ESG factors into their decision-making processes to not only mitigate risks but also to identify companies with strong sustainability practices and long-term growth potential.

- ESG Integration in Investment Strategies: Investors are integrating ESG factors into their portfolios using various approaches such as negative screening, positive screening, ESG integration, and thematic investing. Companies that excel in areas like environmental stewardship, social responsibility, and good governance are attracting more investment, leading to a virtuous cycle of sustainable practices and financial performance.

- ESG Funds’ Performance Outshining Traditional Investments: Numerous studies and real-world performance data indicate that ESG funds have consistently outperformed traditional investment funds in recent years. This trend defies the outdated notion that sustainability comes at the expense of financial returns. Instead, companies that actively manage ESG risks and seize opportunities are positioned for long-term success.

- ESG Factors as Indicators of Resilience: ESG factors can be viewed as indicators of a company’s resilience in the face of environmental and social challenges. For instance, companies that prioritize environmental sustainability are better positioned to navigate regulatory changes, adapt to resource constraints, and reduce operational costs, thereby enhancing their financial performance.

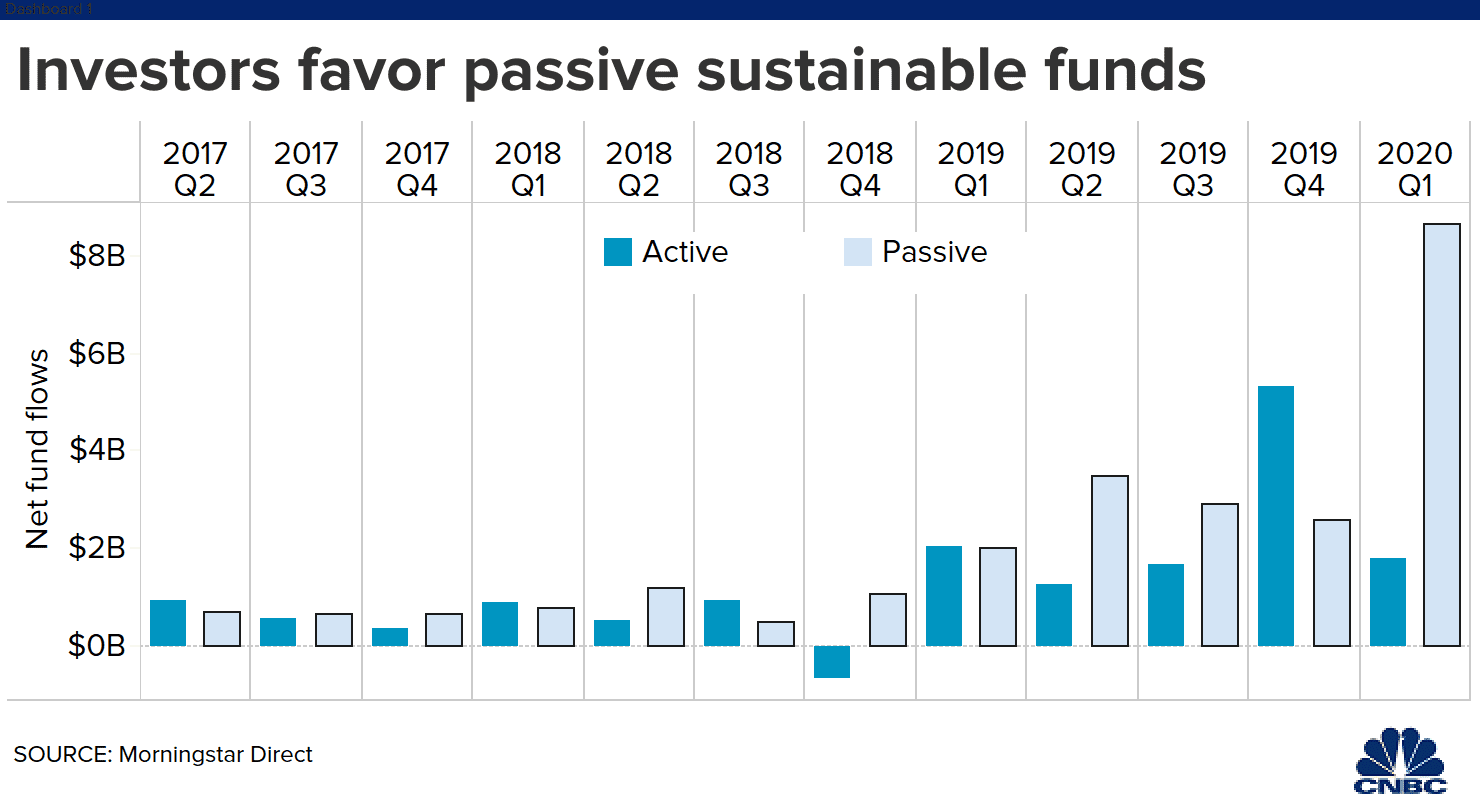

- Investor Demand and Mainstream Adoption: The surge in interest in sustainable investing can be attributed to a growing awareness of pressing global issues like climate change, social inequality, and corporate governance scandals. As consumers and investors demand more ethical and sustainable practices, financial institutions and asset managers have responded by offering a wide range of ESG investment products.

- Corporate Accountability and Transparency: The rise of sustainable investing has compelled companies to increase transparency regarding their ESG practices. Firms are now disclosing more information about their sustainability initiatives, allowing investors to make informed decisions aligned with their values and financial goals.