Introduction: Sustainable investing, also known as socially responsible investing (SRI) or environmental, social, and governance (ESG) investing, has experienced a remarkable surge in popularity. Investors worldwide are increasingly prioritizing ESG factors when making investment decisions, leading to a record high in sustainable investments. This article explores the reasons behind this growing trend, the impact of sustainable investing on the financial market, and the long-term benefits it offers for both investors and society.

- The Rise of Sustainable Investing: The concept of sustainable investing has been gaining traction in recent years due to growing concerns about climate change, social inequality, and corporate governance issues. Investors are increasingly seeking ways to align their investment choices with their values and promote positive change through their financial decisions.

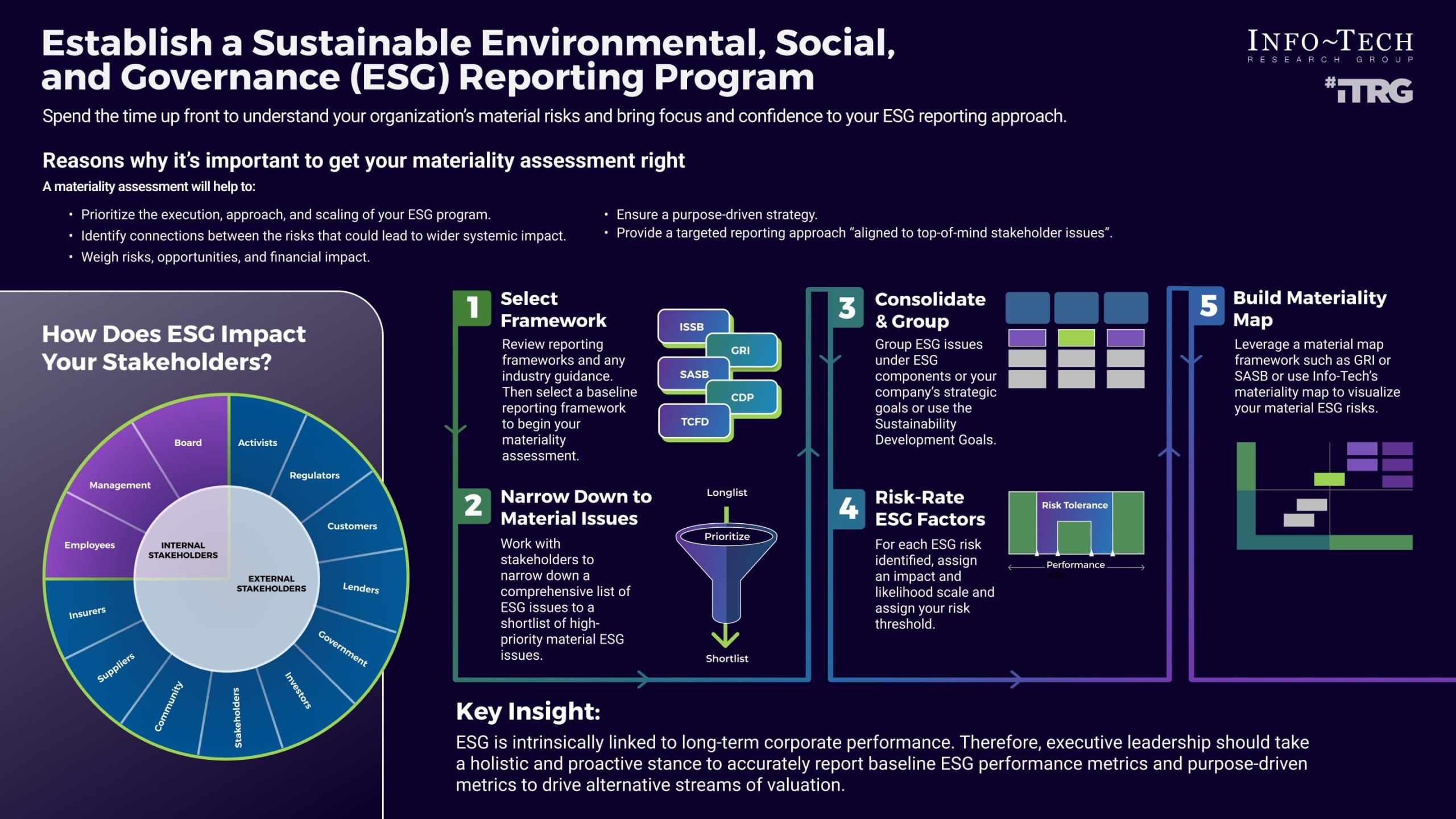

- ESG Integration: Environmental, Social, and Governance (ESG) criteria are the key pillars of sustainable investing. Investors evaluate companies based on their environmental impact, social responsibility, and corporate governance practices. By integrating these factors into their investment strategies, they aim to support companies that prioritize sustainability and ethical practices.

- The Impact on Corporate Behavior: As sustainable investing gains momentum, companies are facing higher scrutiny regarding their ESG performance. This has led to a positive shift in corporate behavior, with many businesses adopting sustainable practices to attract ESG-focused investors and enhance their reputations.

- Performance of Sustainable Investments: Contrary to the outdated belief that sustainable investing comes at the cost of financial returns, recent studies have shown that companies with strong ESG performance tend to outperform their peers over the long term. This has further bolstered the appeal of sustainable investments for risk-conscious investors.

- Asset Managers and Sustainable Funds: Asset management firms have recognized the increasing demand for sustainable investments and have responded by launching a range of sustainable funds. These funds are designed to invest in companies that score high on ESG metrics and meet certain sustainability criteria.

- Regulation and Reporting: Governments and regulatory bodies worldwide are taking steps to promote sustainable investing and ESG disclosure. Mandatory reporting of ESG-related metrics by companies is becoming more common, enabling investors to make more informed decisions and encouraging businesses to improve their sustainability practices.

- Engagement and Advocacy: Sustainable investors often engage with companies in their portfolios, encouraging them to adopt more sustainable practices and address any ESG-related concerns. This shareholder advocacy plays a vital role in effecting positive change within corporations.