Telematics and Usage-Based Coverage in Auto Insurance:

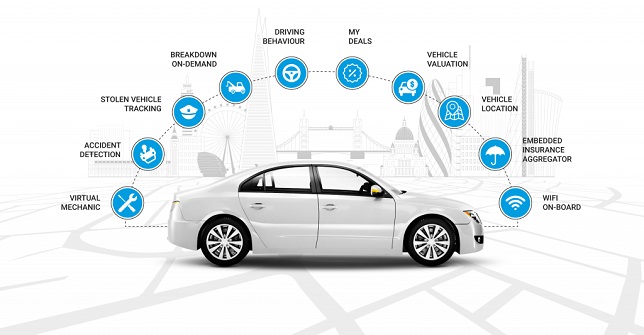

Telematics refers to the technology that enables the collection and transmission of data from vehicles to remote servers. This technology has significantly impacted the auto insurance industry by allowing insurers to gather real-time data about a driver’s behavior, driving habits, and the condition of their vehicle. This data can then be used to tailor insurance policies and pricing more accurately based on individual driving patterns and risk profiles.

Usage-Based Coverage:

Usage-based insurance (UBI) or pay-as-you-go insurance involves adjusting insurance premiums based on actual driving behavior. This is a departure from traditional insurance models that rely on general demographic factors such as age, gender, and location. With telematics devices installed in vehicles, insurers can monitor factors such as:

Mileage: The number of miles driven can affect the risk of accidents. Drivers who cover fewer miles may receive lower premiums.

Driving Behavior: Telematics can track factors like acceleration, braking, and cornering. Safer driving habits may result in lower insurance costs.

Time of Day: Some UBI programs offer lower rates for driving during safer times of the day when there’s less traffic and lower accident risk.

Location: Driving in areas with higher accident rates or crime rates might lead to higher premiums.

Benefits:

Personalized Pricing: UBI allows for more personalized pricing that aligns with an individual’s actual driving habits, potentially resulting in fairer premiums.

Incentives for Safe Driving: The data collected can incentivize drivers to adopt safer driving behaviors, ultimately reducing accidents and insurance claims.

Reduced Costs: Safer drivers could see lower insurance costs, and the overall reduction in accidents can lead to cost savings for insurance companies.

Challenges:

Privacy Concerns: The collection of detailed driving data raises privacy concerns among some drivers who may be uncomfortable with their data being monitored.

Data Accuracy: Telematics devices might not always accurately capture driving behavior, which could lead to incorrect assessments and pricing.

Adoption: Widespread adoption of UBI relies on drivers being willing to install telematics devices, which may not appeal to everyone.

Complexity: Designing and implementing UBI programs can be complex for insurance companies, requiring adjustments to underwriting and pricing models.

Future Implications:

The integration of telematics and usage-based coverage is likely to continue shaping the auto insurance industry. As technology advances, insurers may use more sophisticated data analysis techniques to better predict risk and offer more precise pricing. Additionally, the concept of shared mobility and autonomous vehicles could further influence how insurance is structured and priced.